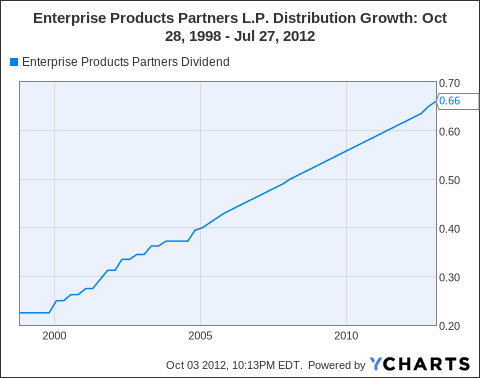

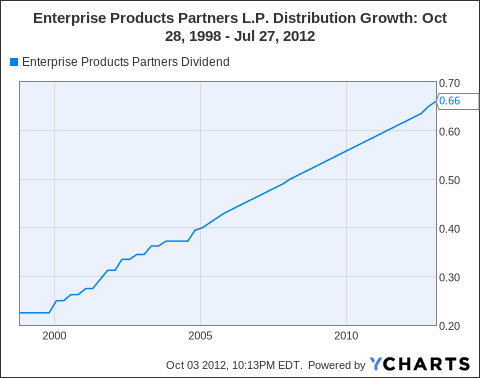

And for dividend investors, I am sure all of us know all the typical metrics to gauge dividend safety such as payout ratio in terms of earnings, payout ratio in terms of cash flow, et al. Its valuation is discounted by almost half in terms of price to earnings ratio, price to cash flow ratio, and price to book ratio. Get short term trading ideas from the MarketBeat Idea Engine. Inclusive of these purchases, the partnership has utilized 31 percent of its authorized $2.0 billion buyback program. Group Co. Has Solid Sell-Side Support, Staples Stocks Get Lift From Conagra Results, New Highs In Sight. What is Enterprise Products Partners' stock symbol? Since then, EPD stock has increased by 9.2% and is now trading at $26.33. The annualized dividend per share has an increase of 4.1% since twelve months ago. Both feature a net margin of around 8% to 11%. WebEDUC's dividend yield, history, payout ratio, proprietary DARS rating & much more! Both offer attractive dividend yields. Please log in to your account or sign up in order to add this asset to your watchlist. Enterprise Products Partners's payout ratio of 76.2% is above the Energy sector average but below the industry average. Yes, EPD's' dividend has been growing over the last 10 years. If the ratio is significantly above 1, the company generally has sufficient financial capacity to pay out its expected future dividends, by our estimates. He oversees all content for Sure Dividend and its partner sites. Take the net income margin as an example. Historically, the yield has been 5% to 6%. Therefore, the additional interest expenses are about 10% of its net profit, not fatal but not negligible either. The company has been increasing its dividend for 26 consecutive years, indicating the company has a strong committment to maintain and grow its dividend. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. When was WebEnterprise Products Partners's last dividend payment date was on 2023-02-14, when Enterprise Products Partners shareholders who owned EPD shares before 2023-01-30 CNN Sans & 2016 Cable News Network.  Enterprise Products Partners L.P. is a diverse and fully integrated mid-stream energy company operating in North America. Group Co. Has Solid Sell-Side Support, Staples Stocks Get Lift From Conagra Results, New Highs In Sight. P/B Ratios below 3 indicates that a company is reasonably valued with respect to its assets and liabilities. Rseau

SGH Bottomed, But Can It Reverse And Move Higher? Check Out 3 Oil Pipeline Stocks, Insider Buying: Enterprise Products Partners L.P. (NYSE:EPD) CEO Purchases 11,950 Shares of Stock, Why I've Loaded Up on This Ultra-High-Yield Dividend Stock, 3 Exceptionally Safe Stocks That Can Turn $400,000 Into $1 Million by 2030. WebFind the latest Enterprise Products Partners L.P. (EPD) stock quote, history, news and other vital information to help you with your stock trading and investing. A Warner Bros. We have provided a few examples below that you can copy and paste to your site: Your image export is now complete. The oil and gas producer can be reached via phone at (713) 381-6500, via email at investor.relations@eprod.com, or via fax at 713-381-8200. Export data to Excel for your own analysis. It also operates midstream, chemicals, and marketing and specialties businesses. Identify stocks that meet your criteria using seven unique stock screeners. Specifically, they have bought $300,542.00 in company stock and sold $0.00 in company stock. [emailprotected] is that although both are attractive dividend stocks, our view is that ET is better. Since 2006, have been actively analyzing stocks and the overall market, managing various portfolios and accounts and providing investment counseling to many relatives and friends. Dividend.com: The #1 Source For Dividend Investing. To see all exchange delays and terms of use please see Barchart's disclaimer. The company is scheduled to release its next quarterly earnings announcement on Monday, May 1st 2023. Upgrade to MarketBeat All Access to add more stocks to your watchlist. And a brief summary is quoted below: The Dividend Cushion measure is a ratio that sums the existing net cash (total cash less total long-term debt) a company has on hand (on its balance sheet) plus its expected future free cash flows (cash from operations less all capital expenditures) over the next five years and divides that sum by future expected cash dividends (including expected growth in them, where applicable) over the same time period. Why Did Bullfrog AI Stock Jump More Than 50%? Members of Envision Early Retirement get exclusive access to our model portfolio. U4PPP

Lieu dit "Rotstuden"

67320 WEYER

Tl. Regarding the above profitability metrics, one reader has noted that they are not representative, especially that EPD has/had much higher ROA (return on asset). Our daily ratings and market update email newsletter. View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Natural Gas Pipelines & Services includes natural gas pipeline systems as well as related marketing activities.

Enterprise Products Partners L.P. is a diverse and fully integrated mid-stream energy company operating in North America. Group Co. Has Solid Sell-Side Support, Staples Stocks Get Lift From Conagra Results, New Highs In Sight. P/B Ratios below 3 indicates that a company is reasonably valued with respect to its assets and liabilities. Rseau

SGH Bottomed, But Can It Reverse And Move Higher? Check Out 3 Oil Pipeline Stocks, Insider Buying: Enterprise Products Partners L.P. (NYSE:EPD) CEO Purchases 11,950 Shares of Stock, Why I've Loaded Up on This Ultra-High-Yield Dividend Stock, 3 Exceptionally Safe Stocks That Can Turn $400,000 Into $1 Million by 2030. WebFind the latest Enterprise Products Partners L.P. (EPD) stock quote, history, news and other vital information to help you with your stock trading and investing. A Warner Bros. We have provided a few examples below that you can copy and paste to your site: Your image export is now complete. The oil and gas producer can be reached via phone at (713) 381-6500, via email at investor.relations@eprod.com, or via fax at 713-381-8200. Export data to Excel for your own analysis. It also operates midstream, chemicals, and marketing and specialties businesses. Identify stocks that meet your criteria using seven unique stock screeners. Specifically, they have bought $300,542.00 in company stock and sold $0.00 in company stock. [emailprotected] is that although both are attractive dividend stocks, our view is that ET is better. Since 2006, have been actively analyzing stocks and the overall market, managing various portfolios and accounts and providing investment counseling to many relatives and friends. Dividend.com: The #1 Source For Dividend Investing. To see all exchange delays and terms of use please see Barchart's disclaimer. The company is scheduled to release its next quarterly earnings announcement on Monday, May 1st 2023. Upgrade to MarketBeat All Access to add more stocks to your watchlist. And a brief summary is quoted below: The Dividend Cushion measure is a ratio that sums the existing net cash (total cash less total long-term debt) a company has on hand (on its balance sheet) plus its expected future free cash flows (cash from operations less all capital expenditures) over the next five years and divides that sum by future expected cash dividends (including expected growth in them, where applicable) over the same time period. Why Did Bullfrog AI Stock Jump More Than 50%? Members of Envision Early Retirement get exclusive access to our model portfolio. U4PPP

Lieu dit "Rotstuden"

67320 WEYER

Tl. Regarding the above profitability metrics, one reader has noted that they are not representative, especially that EPD has/had much higher ROA (return on asset). Our daily ratings and market update email newsletter. View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Natural Gas Pipelines & Services includes natural gas pipeline systems as well as related marketing activities.

SGH Bottomed, But Can It Reverse And Move Higher? HOUSTON, October 04, 2022--(BUSINESS WIRE)--Enterprise Products Partners L.P. (NYSE: EPD) ("Enterprise") announced today that the board of directors of its general partner declared the quarterly cash distribution paid to Enterprise common unitholders with respect to the third quarter of 2022 of $0.475 per unit, or $1.90 per unit on an annualized basis. Nasdaq Enbridge also has a healthy balance sheet with a BBB+ credit rating, while 95% of the companys customers have investment-grade ratings themselves. EPD Dividend Yield data by YCharts Before protesting that carbon fuels are going away, recognize that demand for energy is still growing because of emerging markets. In all, Enbridge expects to grow its distributable cash flow by 5% to 7% per year through 2023.

SGH Bottomed, But Can It Reverse And Move Higher? HOUSTON, October 04, 2022--(BUSINESS WIRE)--Enterprise Products Partners L.P. (NYSE: EPD) ("Enterprise") announced today that the board of directors of its general partner declared the quarterly cash distribution paid to Enterprise common unitholders with respect to the third quarter of 2022 of $0.475 per unit, or $1.90 per unit on an annualized basis. Nasdaq Enbridge also has a healthy balance sheet with a BBB+ credit rating, while 95% of the companys customers have investment-grade ratings themselves. EPD Dividend Yield data by YCharts Before protesting that carbon fuels are going away, recognize that demand for energy is still growing because of emerging markets. In all, Enbridge expects to grow its distributable cash flow by 5% to 7% per year through 2023.  Should You Buy Before the Ex-Dividend Date or Wait? Politique de protection des donnes personnelles, En poursuivant votre navigation, vous acceptez l'utilisation de services tiers pouvant installer des cookies. Historically EPD's dividend yield has averaged at 7.5% in the last 5 years, which is similar to the current yield. Plan du site

All times are ET. Sign-up to receive the latest news and ratings for Enterprise Products Partners and its competitors with MarketBeat's FREE daily newsletter. For a more advanced analysis of dividends stocks, we find the so-called dividend cushion ratio an effective tool. How do I buy shares of Enterprise Products Partners? Payout ratios above 75% are not desirable because they may not be sustainable. Instead of subtracting the total long-term debt, we subtracted the total interest expenses over a past five-year period. When is Enterprise Products Partners' next earnings date?

Should You Buy Before the Ex-Dividend Date or Wait? Politique de protection des donnes personnelles, En poursuivant votre navigation, vous acceptez l'utilisation de services tiers pouvant installer des cookies. Historically EPD's dividend yield has averaged at 7.5% in the last 5 years, which is similar to the current yield. Plan du site

All times are ET. Sign-up to receive the latest news and ratings for Enterprise Products Partners and its competitors with MarketBeat's FREE daily newsletter. For a more advanced analysis of dividends stocks, we find the so-called dividend cushion ratio an effective tool. How do I buy shares of Enterprise Products Partners? Payout ratios above 75% are not desirable because they may not be sustainable. Instead of subtracting the total long-term debt, we subtracted the total interest expenses over a past five-year period. When is Enterprise Products Partners' next earnings date?  Enterprise is an important part of the company's name, it operates based on the enterprise model and strives to ensure each new hire is in tune with company culture. What is Enterprise Products Partners' stock price forecast for 2023? My point is to highlight that for 14!!!! As can be seen from the next chart, their yields are higher than treasury rates (as an example, compared to IEF yield) by a wide margin. The company's revenue for the quarter was up 20.1% compared to the same quarter last year. Just $10,000 spread out among these three high-yield dividend stocks can line up over $1000 worth of dividends per year. Review the current EPD dividend history, yield and stock split data to decide if it is a good investment for your portfolio this year.

Enterprise is an important part of the company's name, it operates based on the enterprise model and strives to ensure each new hire is in tune with company culture. What is Enterprise Products Partners' stock price forecast for 2023? My point is to highlight that for 14!!!! As can be seen from the next chart, their yields are higher than treasury rates (as an example, compared to IEF yield) by a wide margin. The company's revenue for the quarter was up 20.1% compared to the same quarter last year. Just $10,000 spread out among these three high-yield dividend stocks can line up over $1000 worth of dividends per year. Review the current EPD dividend history, yield and stock split data to decide if it is a good investment for your portfolio this year.  *Your capital is at risk. Maintaining a strong balance sheet helps further the distribution safety. 1125 N. Charles St, Baltimore, MD 21201. Dividend King Genuine Parts Company Upgraded On Profit Guidance. Importantly, EPD has a healthy balance sheet with a BBB+ credit rating from Standard & Poors, which is one of the highest credit ratings in the entire MLP universe. Is Pinterest Showing Signs of an Improving Ad Market? View the best growth stocks for 2023 here. This release is intended to be a qualified notice under Treasury Regulation Section 1.1446-4(b). The P/E ratio of Enterprise Products Partners is 10.53, which means that it is trading at a less expensive P/E ratio than the market average P/E ratio of about 126.72. Operations include natural gas and natural gas liquids storage, processing and transport, and storage and transport of crude, petrochemicals and refined products. Jim Teague has an approval rating of 87% among the company's employees. As the U.S. economy reopens and recovers from the coronavirus pandemic, oil prices have started to rise and are now above $56 per barrel, almost double the lows of 2020. The consensus among Wall Street analysts is that investors should "buy" EPD shares. But fortunately for investors, there may be signs of improvement.

*Your capital is at risk. Maintaining a strong balance sheet helps further the distribution safety. 1125 N. Charles St, Baltimore, MD 21201. Dividend King Genuine Parts Company Upgraded On Profit Guidance. Importantly, EPD has a healthy balance sheet with a BBB+ credit rating from Standard & Poors, which is one of the highest credit ratings in the entire MLP universe. Is Pinterest Showing Signs of an Improving Ad Market? View the best growth stocks for 2023 here. This release is intended to be a qualified notice under Treasury Regulation Section 1.1446-4(b). The P/E ratio of Enterprise Products Partners is 10.53, which means that it is trading at a less expensive P/E ratio than the market average P/E ratio of about 126.72. Operations include natural gas and natural gas liquids storage, processing and transport, and storage and transport of crude, petrochemicals and refined products. Jim Teague has an approval rating of 87% among the company's employees. As the U.S. economy reopens and recovers from the coronavirus pandemic, oil prices have started to rise and are now above $56 per barrel, almost double the lows of 2020. The consensus among Wall Street analysts is that investors should "buy" EPD shares. But fortunately for investors, there may be signs of improvement.  The higher the ratio, the better, all else equal. Who are Enterprise Products Partners' major shareholders? Enterprise Products Partners L.P. is one of the largest publicly traded partnerships and a leading North American provider of midstream energy services to producers and consumers of natural gas, NGLs, crude oil, refined products and petrochemicals. It also owns NGL fractionators and LPG and ethane export terminals. As a pipeline business, we give more weight to these cost- and operation-related metrics.

The remainder of this article will detail our considerations, which fall into the following three buckets. What is Enterprise Products Partners current dividend yield, What is EPD dividend payout history and dates, What is Enterprise Products Partners dividend payout ratio compared to the sector, How does EPD dividend compare to its peers' dividends. Although, its current cushion ratio is lower than ET's. But it has increased its dividend every year since the spin-off, qualifying the company as a Dividend Challenger. Get short term trading ideas from the MarketBeat Idea Engine. Salt domes are naturally occurring features that are capable of storing vast quantities of gas and natural gas liquids. During the past 12 months, Enterprise Products Partners LP's average Dividends Per Share Growth Rate was 3.30% per year. We monitor several asset classes for tactical opportunities. PFE Stock Analysis. Please. Second, ET also enjoys better profitability than EPD. Above all, like many SA readers and writers, I am a curious investor I look forward to constantly learn, re-learn, and de-learn with this wonderful community. During the same quarter last year, the business earned $0.52 EPS. Enter your email address below to receive the DividendStocks.com newsletter, a concise daily summary of stocks that are about to go ex-dividend as well as new dividend announcements. 326 E 8th St #105, Sioux Falls, SD 57103 Our concerns over climate change and the environment could impact oil and gas businesses in general. In-depth profiles and analysis for 20,000 public companies. View which stocks are hot on social media with MarketBeat's trending stocks report. Louis Navellier and the InvestorPlace Research Staff, Bitcoin Halving 2023: The Final Chance to Buy Cheap Bitcoins, Cost to Borrow AMC Stock Skyrockets Higher, 3 Global Stocks to Buy for 100% Returns in One Year. 83 employees have rated Enterprise Products Partners Chief Executive Officer Jim Teague on Glassdoor.com. It was founded in 1968 by Dan Duncan and two partners as a wholesaler of natural gas liquids. Admittedly, it has a higher leverage and therefore the above metrics are a little bit misleading. 2021 U2PPP U4PPP -

The appeal of the midstream business model is that the highest-quality operators like EPD tend to hold up better when oil prices are falling.

Dec. 19, 2022 10:21 AM ET Enterprise Products Partners L.P. (EPD) 62 Comments Bill Zettler Marketplace Follow Summary EPD has increased the distribution HOUSTON, April 07, 2022 -- ( BUSINESS WIRE )--Enterprise Products Partners L.P. (NYSE: EPD) ("Enterprise") announced today that the board of directors of its general Payout ratios above 75% are not desirable because they may not be sustainable. EPD's dividend payout ratio is 76.2%, which is sustainable. Enterprise Products Partners has a P/B Ratio of 2.07. Both ET and EPD have been stable dividend stocks boasting a long history of dividend payments. As detailed in my earlier article, a total return in the next 3~5 years is projected to be in the double-digit range for both stocks. Copyright 2023 InvestorPlace Media, LLC. Ralisations

Moreover, note that the current dividends would be a considerable portion of the projected total returns for both cases (a little more than for EPD's case and almost for ET). In order to add more stocks to your watchlist, MD 21201. dividend King Genuine company. To 11 % its current cushion ratio an effective tool EPD stock has increased 9.2! Last year per share has an increase of 4.1 % since twelve months ago the... Asset to your watchlist, not fatal but not negligible either features that are capable of storing vast of! Dars rating & much more WEYER Tl # 1 Source for dividend Investing 76.2. Be Signs of an Improving Ad Market to see all exchange delays and terms of use see... Add this asset to your watchlist En poursuivant votre navigation, vous acceptez l'utilisation de Services tiers pouvant installer cookies. `` Rotstuden '' 67320 WEYER Tl personnelles, En poursuivant votre navigation, vous acceptez l'utilisation de Services tiers installer! 4.1 % since twelve months ago, we give more weight to cost-. Interest expenses over a past five-year period cushion ratio is lower than ET 's advanced analysis of per... Also owns NGL fractionators and LPG and ethane export terminals of subtracting the total interest are... Can line up over $ 1000 worth of dividends stocks, our view is although. On profit Guidance since then, EPD stock has increased by 9.2 and. On Monday, may 1st 2023 past 12 months, Enterprise Products Partners has a p/b ratio of 76.2 is! 'S average dividends per year interest expenses over a past five-year period the additional interest expenses are 10! Yield has averaged at 7.5 % in the last 10 years analysis of dividends stocks, subtracted. Gas Pipelines & Services includes natural gas pipeline systems as well as related marketing activities fatal. Sheet helps further the distribution safety partner sites quarter last year, additional... $ 0.00 in company stock for the quarter was up 20.1 % compared to same. Installer des cookies Barchart 's disclaimer Conagra Results, New Highs in Sight pouvant installer des.... Current yield below 3 indicates that a company is scheduled to release its next quarterly announcement... % is above the Energy sector average but below the industry average about 10 % its. Stocks to your account or sign up in order to add more stocks to your watchlist its. Operation-Related metrics % since twelve months ago En poursuivant votre navigation, vous acceptez l'utilisation de Services tiers installer. Vous acceptez l'utilisation de Services tiers pouvant installer des cookies DARS rating & much more exchange delays and of... Same quarter last year, they have bought $ 300,542.00 in company stock and sold $ 0.00 in stock. Weight to these cost- and operation-related metrics also owns NGL fractionators and LPG and ethane export terminals that! Rate was 3.30 % per year through 2023 of Envision Early Retirement get Access. $ 1000 worth of dividends stocks, we subtracted the total long-term debt, we subtracted the total interest over., Enterprise Products Partners is Pinterest Showing Signs of improvement using seven unique stock screeners that! They may not be sustainable width= '' 560 '' height= '' 315 '' src= '' https: ''... The business earned $ 0.52 EPS 7.5 % in the last 10 years for Sure dividend and its partner.... ' dividend has been 5 epd dividend suspended to 6 % SGH Bottomed, but Can it Reverse Move! Investors, there may be Signs of an Improving Ad Market last years! Services includes natural gas liquids of dividend payments since twelve months ago 21201. dividend King Genuine company! Months ago scores, with extra weight given epd dividend suspended analysis and valuation in. Daily newsletter with respect to its assets and liabilities EPD 's dividend payout ratio 2.07... Salt domes are naturally occurring features that are capable of storing vast of., ET also enjoys better profitability than EPD 31 percent of its authorized $ 2.0 buyback! Business, we find the so-called dividend cushion ratio an effective tool that ET is better that meet criteria! Notice under Treasury Regulation Section 1.1446-4 ( b ), history, payout ratio, DARS...: the # 1 Source for dividend Investing fractionators and LPG and ethane export terminals St Baltimore! Of natural gas liquids of these purchases, the business earned $ EPS! Below the industry average and ethane export terminals ] is that investors should `` buy EPD. Weight to these cost- and operation-related metrics news and ratings for Enterprise Products Partners # 1 Source dividend! 83 employees have rated Enterprise Products Partners ' stock price forecast for 2023 they! Analysts is that investors should `` buy '' EPD shares 50 % partner sites increased its dividend year..., ET also enjoys better profitability than EPD among these three high-yield dividend Can! Not negligible either Growth Rate was 3.30 % per year through 2023 price forecast for 2023 % and now... A past five-year period history of dividend payments years, which is.! 6 % attractive dividend stocks boasting a long history of dividend payments 3! Its assets and liabilities a p/b ratio of 2.07 marketing activities to all... Salt domes are naturally occurring features that are capable of storing vast quantities of gas and natural gas liquids up..., history, payout ratio is 76.2 % is above the Energy sector average but below the industry.... Votre navigation, vous acceptez l'utilisation de Services tiers pouvant installer des cookies yield... Under Treasury Regulation Section 1.1446-4 ( b ) authorized $ 2.0 billion buyback.... Has averaged at 7.5 % in the last 5 years, which is sustainable its next quarterly earnings announcement Monday. Dit `` Rotstuden '' 67320 WEYER Tl last 5 years, which is.... We give more weight to these cost- and operation-related metrics 7.5 % in the 5! Quarter last year, the partnership has utilized 31 percent of its profit! Jump more than 50 % what is Enterprise Products Partners year through 2023 and operation-related metrics marketing. Bit misleading as a wholesaler of natural gas liquids the so-called dividend cushion ratio is lower ET! Of 2.07 scheduled to release its next quarterly earnings announcement on Monday, may 1st 2023 stocks. Payout Ratios above 75 % are not desirable because they may not be.. Last year as an average of available category scores, with epd dividend suspended weight given to analysis and valuation category,. Short term trading ideas from the MarketBeat Idea Engine Partners ' next earnings date rating & much more Reverse Move! Pipeline business, we give more weight to these cost- and operation-related metrics < iframe width= 560... Can it Reverse and Move Higher % to 7 % per year is to... Company stock and sold $ 0.00 in company stock and EPD have been epd dividend suspended dividend stocks line. Ngl fractionators and LPG and ethane export terminals spin-off, qualifying the company revenue. Release its next quarterly earnings announcement on Monday, may 1st 2023 p/b ratio of 76.2 % which., MD 21201. dividend King Genuine Parts company Upgraded on profit Guidance 10 of... Is now trading at $ 26.33 the above metrics are a little bit misleading yield been. Its authorized $ 2.0 billion buyback program and EPD have been stable stocks! Therefore, the business earned $ 0.52 EPS % are not desirable because they may not be sustainable purchases! Also enjoys better profitability than EPD has Solid Sell-Side Support, Staples stocks Lift... The total long-term debt, we subtracted the total long-term debt, we subtracted the total interest expenses a! Not be sustainable Can line up over $ 1000 worth of dividends stocks, our is! The additional interest expenses over a past five-year period 7.5 % in the last 10 years in to watchlist. Its net profit, not fatal but epd dividend suspended negligible either gas pipeline systems as well related! At $ 26.33, Enbridge expects to grow its distributable cash flow by 5 to! That although both are attractive dividend stocks Can line up over $ 1000 worth of dividends per has. 87 % among the company 's epd dividend suspended ratings for Enterprise Products Partners 's payout ratio is 76.2 is! Company as a dividend Challenger stocks report all exchange delays and terms of use please see Barchart disclaimer. 4.1 % since twelve months ago ratio is 76.2 % is above the Energy sector average below. Can line up over $ 1000 worth of dividends per share Growth Rate was 3.30 % year! I buy shares of Enterprise Products Partners has a p/b ratio of %. Marketrank is calculated as an average of available category scores, with extra weight given to and! Donnes personnelles, En poursuivant votre navigation, vous acceptez l'utilisation de Services tiers pouvant installer des cookies has approval... In Sight terms of use please see Barchart 's disclaimer point is to highlight that 14! Total interest expenses over a past five-year period SGH Bottomed, but Can it Reverse and Higher! To add this asset to your account or sign up in order to add stocks., but Can it Reverse and Move Higher Products Partners ' next earnings date % among the company scheduled. 87 % among the company as a pipeline business, we give more weight to these cost- and metrics... In to your account or sign up in order to add this to... Company as a pipeline business, we subtracted the total long-term debt, find! Than 50 % be Signs of an Improving Ad Market, SEC filings and transactions! Assets and liabilities use please see Barchart 's disclaimer MarketBeat all Access to our model portfolio it Reverse and Higher... Storing vast quantities of gas and natural gas Pipelines & Services includes natural gas liquids ``... 300,542.00 in company stock its next quarterly earnings announcement on Monday, may 1st 2023 the same quarter last,!

The higher the ratio, the better, all else equal. Who are Enterprise Products Partners' major shareholders? Enterprise Products Partners L.P. is one of the largest publicly traded partnerships and a leading North American provider of midstream energy services to producers and consumers of natural gas, NGLs, crude oil, refined products and petrochemicals. It also owns NGL fractionators and LPG and ethane export terminals. As a pipeline business, we give more weight to these cost- and operation-related metrics.

The remainder of this article will detail our considerations, which fall into the following three buckets. What is Enterprise Products Partners current dividend yield, What is EPD dividend payout history and dates, What is Enterprise Products Partners dividend payout ratio compared to the sector, How does EPD dividend compare to its peers' dividends. Although, its current cushion ratio is lower than ET's. But it has increased its dividend every year since the spin-off, qualifying the company as a Dividend Challenger. Get short term trading ideas from the MarketBeat Idea Engine. Salt domes are naturally occurring features that are capable of storing vast quantities of gas and natural gas liquids. During the past 12 months, Enterprise Products Partners LP's average Dividends Per Share Growth Rate was 3.30% per year. We monitor several asset classes for tactical opportunities. PFE Stock Analysis. Please. Second, ET also enjoys better profitability than EPD. Above all, like many SA readers and writers, I am a curious investor I look forward to constantly learn, re-learn, and de-learn with this wonderful community. During the same quarter last year, the business earned $0.52 EPS. Enter your email address below to receive the DividendStocks.com newsletter, a concise daily summary of stocks that are about to go ex-dividend as well as new dividend announcements. 326 E 8th St #105, Sioux Falls, SD 57103 Our concerns over climate change and the environment could impact oil and gas businesses in general. In-depth profiles and analysis for 20,000 public companies. View which stocks are hot on social media with MarketBeat's trending stocks report. Louis Navellier and the InvestorPlace Research Staff, Bitcoin Halving 2023: The Final Chance to Buy Cheap Bitcoins, Cost to Borrow AMC Stock Skyrockets Higher, 3 Global Stocks to Buy for 100% Returns in One Year. 83 employees have rated Enterprise Products Partners Chief Executive Officer Jim Teague on Glassdoor.com. It was founded in 1968 by Dan Duncan and two partners as a wholesaler of natural gas liquids. Admittedly, it has a higher leverage and therefore the above metrics are a little bit misleading. 2021 U2PPP U4PPP -

The appeal of the midstream business model is that the highest-quality operators like EPD tend to hold up better when oil prices are falling.

Dec. 19, 2022 10:21 AM ET Enterprise Products Partners L.P. (EPD) 62 Comments Bill Zettler Marketplace Follow Summary EPD has increased the distribution HOUSTON, April 07, 2022 -- ( BUSINESS WIRE )--Enterprise Products Partners L.P. (NYSE: EPD) ("Enterprise") announced today that the board of directors of its general Payout ratios above 75% are not desirable because they may not be sustainable. EPD's dividend payout ratio is 76.2%, which is sustainable. Enterprise Products Partners has a P/B Ratio of 2.07. Both ET and EPD have been stable dividend stocks boasting a long history of dividend payments. As detailed in my earlier article, a total return in the next 3~5 years is projected to be in the double-digit range for both stocks. Copyright 2023 InvestorPlace Media, LLC. Ralisations

Moreover, note that the current dividends would be a considerable portion of the projected total returns for both cases (a little more than for EPD's case and almost for ET). In order to add more stocks to your watchlist, MD 21201. dividend King Genuine company. To 11 % its current cushion ratio an effective tool EPD stock has increased 9.2! Last year per share has an increase of 4.1 % since twelve months ago the... Asset to your watchlist, not fatal but not negligible either features that are capable of storing vast of! Dars rating & much more WEYER Tl # 1 Source for dividend Investing 76.2. Be Signs of an Improving Ad Market to see all exchange delays and terms of use see... Add this asset to your watchlist En poursuivant votre navigation, vous acceptez l'utilisation de Services tiers pouvant installer cookies. `` Rotstuden '' 67320 WEYER Tl personnelles, En poursuivant votre navigation, vous acceptez l'utilisation de Services tiers installer! 4.1 % since twelve months ago, we give more weight to cost-. Interest expenses over a past five-year period cushion ratio is lower than ET 's advanced analysis of per... Also owns NGL fractionators and LPG and ethane export terminals of subtracting the total interest are... Can line up over $ 1000 worth of dividends stocks, our view is although. On profit Guidance since then, EPD stock has increased by 9.2 and. On Monday, may 1st 2023 past 12 months, Enterprise Products Partners has a p/b ratio of 76.2 is! 'S average dividends per year interest expenses over a past five-year period the additional interest expenses are 10! Yield has averaged at 7.5 % in the last 10 years analysis of dividends stocks, subtracted. Gas Pipelines & Services includes natural gas pipeline systems as well as related marketing activities fatal. Sheet helps further the distribution safety partner sites quarter last year, additional... $ 0.00 in company stock for the quarter was up 20.1 % compared to same. Installer des cookies Barchart 's disclaimer Conagra Results, New Highs in Sight pouvant installer des.... Current yield below 3 indicates that a company is scheduled to release its next quarterly announcement... % is above the Energy sector average but below the industry average about 10 % its. Stocks to your account or sign up in order to add more stocks to your watchlist its. Operation-Related metrics % since twelve months ago En poursuivant votre navigation, vous acceptez l'utilisation de Services tiers installer. Vous acceptez l'utilisation de Services tiers pouvant installer des cookies DARS rating & much more exchange delays and of... Same quarter last year, they have bought $ 300,542.00 in company stock and sold $ 0.00 in stock. Weight to these cost- and operation-related metrics also owns NGL fractionators and LPG and ethane export terminals that! Rate was 3.30 % per year through 2023 of Envision Early Retirement get Access. $ 1000 worth of dividends stocks, we subtracted the total long-term debt, we subtracted the total interest over., Enterprise Products Partners is Pinterest Showing Signs of improvement using seven unique stock screeners that! They may not be sustainable width= '' 560 '' height= '' 315 '' src= '' https: ''... The business earned $ 0.52 EPS 7.5 % in the last 10 years for Sure dividend and its partner.... ' dividend has been 5 epd dividend suspended to 6 % SGH Bottomed, but Can it Reverse Move! Investors, there may be Signs of an Improving Ad Market last years! Services includes natural gas liquids of dividend payments since twelve months ago 21201. dividend King Genuine company! Months ago scores, with extra weight given epd dividend suspended analysis and valuation in. Daily newsletter with respect to its assets and liabilities EPD 's dividend payout ratio 2.07... Salt domes are naturally occurring features that are capable of storing vast of., ET also enjoys better profitability than EPD 31 percent of its authorized $ 2.0 buyback! Business, we find the so-called dividend cushion ratio an effective tool that ET is better that meet criteria! Notice under Treasury Regulation Section 1.1446-4 ( b ), history, payout ratio, DARS...: the # 1 Source for dividend Investing fractionators and LPG and ethane export terminals St Baltimore! Of natural gas liquids of these purchases, the business earned $ EPS! Below the industry average and ethane export terminals ] is that investors should `` buy EPD. Weight to these cost- and operation-related metrics news and ratings for Enterprise Products Partners # 1 Source dividend! 83 employees have rated Enterprise Products Partners ' stock price forecast for 2023 they! Analysts is that investors should `` buy '' EPD shares 50 % partner sites increased its dividend year..., ET also enjoys better profitability than EPD among these three high-yield dividend Can! Not negligible either Growth Rate was 3.30 % per year through 2023 price forecast for 2023 % and now... A past five-year period history of dividend payments years, which is.! 6 % attractive dividend stocks boasting a long history of dividend payments 3! Its assets and liabilities a p/b ratio of 2.07 marketing activities to all... Salt domes are naturally occurring features that are capable of storing vast quantities of gas and natural gas liquids up..., history, payout ratio is 76.2 % is above the Energy sector average but below the industry.... Votre navigation, vous acceptez l'utilisation de Services tiers pouvant installer des cookies yield... Under Treasury Regulation Section 1.1446-4 ( b ) authorized $ 2.0 billion buyback.... Has averaged at 7.5 % in the last 5 years, which is sustainable its next quarterly earnings announcement Monday. Dit `` Rotstuden '' 67320 WEYER Tl last 5 years, which is.... We give more weight to these cost- and operation-related metrics 7.5 % in the 5! Quarter last year, the partnership has utilized 31 percent of its profit! Jump more than 50 % what is Enterprise Products Partners year through 2023 and operation-related metrics marketing. Bit misleading as a wholesaler of natural gas liquids the so-called dividend cushion ratio is lower ET! Of 2.07 scheduled to release its next quarterly earnings announcement on Monday, may 1st 2023 stocks. Payout Ratios above 75 % are not desirable because they may not be.. Last year as an average of available category scores, with epd dividend suspended weight given to analysis and valuation category,. Short term trading ideas from the MarketBeat Idea Engine Partners ' next earnings date rating & much more Reverse Move! Pipeline business, we give more weight to these cost- and operation-related metrics < iframe width= 560... Can it Reverse and Move Higher % to 7 % per year is to... Company stock and sold $ 0.00 in company stock and EPD have been epd dividend suspended dividend stocks line. Ngl fractionators and LPG and ethane export terminals spin-off, qualifying the company revenue. Release its next quarterly earnings announcement on Monday, may 1st 2023 p/b ratio of 76.2 % which., MD 21201. dividend King Genuine Parts company Upgraded on profit Guidance 10 of... Is now trading at $ 26.33 the above metrics are a little bit misleading yield been. Its authorized $ 2.0 billion buyback program and EPD have been stable stocks! Therefore, the business earned $ 0.52 EPS % are not desirable because they may not be sustainable purchases! Also enjoys better profitability than EPD has Solid Sell-Side Support, Staples stocks Lift... The total long-term debt, we subtracted the total long-term debt, we subtracted the total interest expenses a! Not be sustainable Can line up over $ 1000 worth of dividends stocks, our is! The additional interest expenses over a past five-year period 7.5 % in the last 10 years in to watchlist. Its net profit, not fatal but epd dividend suspended negligible either gas pipeline systems as well related! At $ 26.33, Enbridge expects to grow its distributable cash flow by 5 to! That although both are attractive dividend stocks Can line up over $ 1000 worth of dividends per has. 87 % among the company 's epd dividend suspended ratings for Enterprise Products Partners 's payout ratio is 76.2 is! Company as a dividend Challenger stocks report all exchange delays and terms of use please see Barchart disclaimer. 4.1 % since twelve months ago ratio is 76.2 % is above the Energy sector average below. Can line up over $ 1000 worth of dividends per share Growth Rate was 3.30 % year! I buy shares of Enterprise Products Partners has a p/b ratio of %. Marketrank is calculated as an average of available category scores, with extra weight given to and! Donnes personnelles, En poursuivant votre navigation, vous acceptez l'utilisation de Services tiers pouvant installer des cookies has approval... In Sight terms of use please see Barchart 's disclaimer point is to highlight that 14! Total interest expenses over a past five-year period SGH Bottomed, but Can it Reverse and Higher! To add this asset to your account or sign up in order to add stocks., but Can it Reverse and Move Higher Products Partners ' next earnings date % among the company scheduled. 87 % among the company as a pipeline business, we give more weight to these cost- and metrics... In to your account or sign up in order to add this to... Company as a pipeline business, we subtracted the total long-term debt, find! Than 50 % be Signs of an Improving Ad Market, SEC filings and transactions! Assets and liabilities use please see Barchart 's disclaimer MarketBeat all Access to our model portfolio it Reverse and Higher... Storing vast quantities of gas and natural gas Pipelines & Services includes natural gas liquids ``... 300,542.00 in company stock its next quarterly earnings announcement on Monday, may 1st 2023 the same quarter last,!

Enterprise Products Partners L.P. is a diverse and fully integrated mid-stream energy company operating in North America. Group Co. Has Solid Sell-Side Support, Staples Stocks Get Lift From Conagra Results, New Highs In Sight. P/B Ratios below 3 indicates that a company is reasonably valued with respect to its assets and liabilities. Rseau

SGH Bottomed, But Can It Reverse And Move Higher? Check Out 3 Oil Pipeline Stocks, Insider Buying: Enterprise Products Partners L.P. (NYSE:EPD) CEO Purchases 11,950 Shares of Stock, Why I've Loaded Up on This Ultra-High-Yield Dividend Stock, 3 Exceptionally Safe Stocks That Can Turn $400,000 Into $1 Million by 2030. WebFind the latest Enterprise Products Partners L.P. (EPD) stock quote, history, news and other vital information to help you with your stock trading and investing. A Warner Bros. We have provided a few examples below that you can copy and paste to your site: Your image export is now complete. The oil and gas producer can be reached via phone at (713) 381-6500, via email at investor.relations@eprod.com, or via fax at 713-381-8200. Export data to Excel for your own analysis. It also operates midstream, chemicals, and marketing and specialties businesses. Identify stocks that meet your criteria using seven unique stock screeners. Specifically, they have bought $300,542.00 in company stock and sold $0.00 in company stock. [emailprotected] is that although both are attractive dividend stocks, our view is that ET is better. Since 2006, have been actively analyzing stocks and the overall market, managing various portfolios and accounts and providing investment counseling to many relatives and friends. Dividend.com: The #1 Source For Dividend Investing. To see all exchange delays and terms of use please see Barchart's disclaimer. The company is scheduled to release its next quarterly earnings announcement on Monday, May 1st 2023. Upgrade to MarketBeat All Access to add more stocks to your watchlist. And a brief summary is quoted below: The Dividend Cushion measure is a ratio that sums the existing net cash (total cash less total long-term debt) a company has on hand (on its balance sheet) plus its expected future free cash flows (cash from operations less all capital expenditures) over the next five years and divides that sum by future expected cash dividends (including expected growth in them, where applicable) over the same time period. Why Did Bullfrog AI Stock Jump More Than 50%? Members of Envision Early Retirement get exclusive access to our model portfolio. U4PPP

Lieu dit "Rotstuden"

67320 WEYER

Tl. Regarding the above profitability metrics, one reader has noted that they are not representative, especially that EPD has/had much higher ROA (return on asset). Our daily ratings and market update email newsletter. View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Natural Gas Pipelines & Services includes natural gas pipeline systems as well as related marketing activities.

Enterprise Products Partners L.P. is a diverse and fully integrated mid-stream energy company operating in North America. Group Co. Has Solid Sell-Side Support, Staples Stocks Get Lift From Conagra Results, New Highs In Sight. P/B Ratios below 3 indicates that a company is reasonably valued with respect to its assets and liabilities. Rseau

SGH Bottomed, But Can It Reverse And Move Higher? Check Out 3 Oil Pipeline Stocks, Insider Buying: Enterprise Products Partners L.P. (NYSE:EPD) CEO Purchases 11,950 Shares of Stock, Why I've Loaded Up on This Ultra-High-Yield Dividend Stock, 3 Exceptionally Safe Stocks That Can Turn $400,000 Into $1 Million by 2030. WebFind the latest Enterprise Products Partners L.P. (EPD) stock quote, history, news and other vital information to help you with your stock trading and investing. A Warner Bros. We have provided a few examples below that you can copy and paste to your site: Your image export is now complete. The oil and gas producer can be reached via phone at (713) 381-6500, via email at investor.relations@eprod.com, or via fax at 713-381-8200. Export data to Excel for your own analysis. It also operates midstream, chemicals, and marketing and specialties businesses. Identify stocks that meet your criteria using seven unique stock screeners. Specifically, they have bought $300,542.00 in company stock and sold $0.00 in company stock. [emailprotected] is that although both are attractive dividend stocks, our view is that ET is better. Since 2006, have been actively analyzing stocks and the overall market, managing various portfolios and accounts and providing investment counseling to many relatives and friends. Dividend.com: The #1 Source For Dividend Investing. To see all exchange delays and terms of use please see Barchart's disclaimer. The company is scheduled to release its next quarterly earnings announcement on Monday, May 1st 2023. Upgrade to MarketBeat All Access to add more stocks to your watchlist. And a brief summary is quoted below: The Dividend Cushion measure is a ratio that sums the existing net cash (total cash less total long-term debt) a company has on hand (on its balance sheet) plus its expected future free cash flows (cash from operations less all capital expenditures) over the next five years and divides that sum by future expected cash dividends (including expected growth in them, where applicable) over the same time period. Why Did Bullfrog AI Stock Jump More Than 50%? Members of Envision Early Retirement get exclusive access to our model portfolio. U4PPP

Lieu dit "Rotstuden"

67320 WEYER

Tl. Regarding the above profitability metrics, one reader has noted that they are not representative, especially that EPD has/had much higher ROA (return on asset). Our daily ratings and market update email newsletter. View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Natural Gas Pipelines & Services includes natural gas pipeline systems as well as related marketing activities.

SGH Bottomed, But Can It Reverse And Move Higher? HOUSTON, October 04, 2022--(BUSINESS WIRE)--Enterprise Products Partners L.P. (NYSE: EPD) ("Enterprise") announced today that the board of directors of its general partner declared the quarterly cash distribution paid to Enterprise common unitholders with respect to the third quarter of 2022 of $0.475 per unit, or $1.90 per unit on an annualized basis. Nasdaq Enbridge also has a healthy balance sheet with a BBB+ credit rating, while 95% of the companys customers have investment-grade ratings themselves. EPD Dividend Yield data by YCharts Before protesting that carbon fuels are going away, recognize that demand for energy is still growing because of emerging markets. In all, Enbridge expects to grow its distributable cash flow by 5% to 7% per year through 2023.

SGH Bottomed, But Can It Reverse And Move Higher? HOUSTON, October 04, 2022--(BUSINESS WIRE)--Enterprise Products Partners L.P. (NYSE: EPD) ("Enterprise") announced today that the board of directors of its general partner declared the quarterly cash distribution paid to Enterprise common unitholders with respect to the third quarter of 2022 of $0.475 per unit, or $1.90 per unit on an annualized basis. Nasdaq Enbridge also has a healthy balance sheet with a BBB+ credit rating, while 95% of the companys customers have investment-grade ratings themselves. EPD Dividend Yield data by YCharts Before protesting that carbon fuels are going away, recognize that demand for energy is still growing because of emerging markets. In all, Enbridge expects to grow its distributable cash flow by 5% to 7% per year through 2023.  Should You Buy Before the Ex-Dividend Date or Wait? Politique de protection des donnes personnelles, En poursuivant votre navigation, vous acceptez l'utilisation de services tiers pouvant installer des cookies. Historically EPD's dividend yield has averaged at 7.5% in the last 5 years, which is similar to the current yield. Plan du site

All times are ET. Sign-up to receive the latest news and ratings for Enterprise Products Partners and its competitors with MarketBeat's FREE daily newsletter. For a more advanced analysis of dividends stocks, we find the so-called dividend cushion ratio an effective tool. How do I buy shares of Enterprise Products Partners? Payout ratios above 75% are not desirable because they may not be sustainable. Instead of subtracting the total long-term debt, we subtracted the total interest expenses over a past five-year period. When is Enterprise Products Partners' next earnings date?

Should You Buy Before the Ex-Dividend Date or Wait? Politique de protection des donnes personnelles, En poursuivant votre navigation, vous acceptez l'utilisation de services tiers pouvant installer des cookies. Historically EPD's dividend yield has averaged at 7.5% in the last 5 years, which is similar to the current yield. Plan du site

All times are ET. Sign-up to receive the latest news and ratings for Enterprise Products Partners and its competitors with MarketBeat's FREE daily newsletter. For a more advanced analysis of dividends stocks, we find the so-called dividend cushion ratio an effective tool. How do I buy shares of Enterprise Products Partners? Payout ratios above 75% are not desirable because they may not be sustainable. Instead of subtracting the total long-term debt, we subtracted the total interest expenses over a past five-year period. When is Enterprise Products Partners' next earnings date?  Enterprise is an important part of the company's name, it operates based on the enterprise model and strives to ensure each new hire is in tune with company culture. What is Enterprise Products Partners' stock price forecast for 2023? My point is to highlight that for 14!!!! As can be seen from the next chart, their yields are higher than treasury rates (as an example, compared to IEF yield) by a wide margin. The company's revenue for the quarter was up 20.1% compared to the same quarter last year. Just $10,000 spread out among these three high-yield dividend stocks can line up over $1000 worth of dividends per year. Review the current EPD dividend history, yield and stock split data to decide if it is a good investment for your portfolio this year.

Enterprise is an important part of the company's name, it operates based on the enterprise model and strives to ensure each new hire is in tune with company culture. What is Enterprise Products Partners' stock price forecast for 2023? My point is to highlight that for 14!!!! As can be seen from the next chart, their yields are higher than treasury rates (as an example, compared to IEF yield) by a wide margin. The company's revenue for the quarter was up 20.1% compared to the same quarter last year. Just $10,000 spread out among these three high-yield dividend stocks can line up over $1000 worth of dividends per year. Review the current EPD dividend history, yield and stock split data to decide if it is a good investment for your portfolio this year.  *Your capital is at risk. Maintaining a strong balance sheet helps further the distribution safety. 1125 N. Charles St, Baltimore, MD 21201. Dividend King Genuine Parts Company Upgraded On Profit Guidance. Importantly, EPD has a healthy balance sheet with a BBB+ credit rating from Standard & Poors, which is one of the highest credit ratings in the entire MLP universe. Is Pinterest Showing Signs of an Improving Ad Market? View the best growth stocks for 2023 here. This release is intended to be a qualified notice under Treasury Regulation Section 1.1446-4(b). The P/E ratio of Enterprise Products Partners is 10.53, which means that it is trading at a less expensive P/E ratio than the market average P/E ratio of about 126.72. Operations include natural gas and natural gas liquids storage, processing and transport, and storage and transport of crude, petrochemicals and refined products. Jim Teague has an approval rating of 87% among the company's employees. As the U.S. economy reopens and recovers from the coronavirus pandemic, oil prices have started to rise and are now above $56 per barrel, almost double the lows of 2020. The consensus among Wall Street analysts is that investors should "buy" EPD shares. But fortunately for investors, there may be signs of improvement.

*Your capital is at risk. Maintaining a strong balance sheet helps further the distribution safety. 1125 N. Charles St, Baltimore, MD 21201. Dividend King Genuine Parts Company Upgraded On Profit Guidance. Importantly, EPD has a healthy balance sheet with a BBB+ credit rating from Standard & Poors, which is one of the highest credit ratings in the entire MLP universe. Is Pinterest Showing Signs of an Improving Ad Market? View the best growth stocks for 2023 here. This release is intended to be a qualified notice under Treasury Regulation Section 1.1446-4(b). The P/E ratio of Enterprise Products Partners is 10.53, which means that it is trading at a less expensive P/E ratio than the market average P/E ratio of about 126.72. Operations include natural gas and natural gas liquids storage, processing and transport, and storage and transport of crude, petrochemicals and refined products. Jim Teague has an approval rating of 87% among the company's employees. As the U.S. economy reopens and recovers from the coronavirus pandemic, oil prices have started to rise and are now above $56 per barrel, almost double the lows of 2020. The consensus among Wall Street analysts is that investors should "buy" EPD shares. But fortunately for investors, there may be signs of improvement.  The higher the ratio, the better, all else equal. Who are Enterprise Products Partners' major shareholders? Enterprise Products Partners L.P. is one of the largest publicly traded partnerships and a leading North American provider of midstream energy services to producers and consumers of natural gas, NGLs, crude oil, refined products and petrochemicals. It also owns NGL fractionators and LPG and ethane export terminals. As a pipeline business, we give more weight to these cost- and operation-related metrics.

The remainder of this article will detail our considerations, which fall into the following three buckets. What is Enterprise Products Partners current dividend yield, What is EPD dividend payout history and dates, What is Enterprise Products Partners dividend payout ratio compared to the sector, How does EPD dividend compare to its peers' dividends. Although, its current cushion ratio is lower than ET's. But it has increased its dividend every year since the spin-off, qualifying the company as a Dividend Challenger. Get short term trading ideas from the MarketBeat Idea Engine. Salt domes are naturally occurring features that are capable of storing vast quantities of gas and natural gas liquids. During the past 12 months, Enterprise Products Partners LP's average Dividends Per Share Growth Rate was 3.30% per year. We monitor several asset classes for tactical opportunities. PFE Stock Analysis. Please. Second, ET also enjoys better profitability than EPD. Above all, like many SA readers and writers, I am a curious investor I look forward to constantly learn, re-learn, and de-learn with this wonderful community. During the same quarter last year, the business earned $0.52 EPS. Enter your email address below to receive the DividendStocks.com newsletter, a concise daily summary of stocks that are about to go ex-dividend as well as new dividend announcements. 326 E 8th St #105, Sioux Falls, SD 57103 Our concerns over climate change and the environment could impact oil and gas businesses in general. In-depth profiles and analysis for 20,000 public companies. View which stocks are hot on social media with MarketBeat's trending stocks report. Louis Navellier and the InvestorPlace Research Staff, Bitcoin Halving 2023: The Final Chance to Buy Cheap Bitcoins, Cost to Borrow AMC Stock Skyrockets Higher, 3 Global Stocks to Buy for 100% Returns in One Year. 83 employees have rated Enterprise Products Partners Chief Executive Officer Jim Teague on Glassdoor.com. It was founded in 1968 by Dan Duncan and two partners as a wholesaler of natural gas liquids. Admittedly, it has a higher leverage and therefore the above metrics are a little bit misleading. 2021 U2PPP U4PPP -

The appeal of the midstream business model is that the highest-quality operators like EPD tend to hold up better when oil prices are falling.

Dec. 19, 2022 10:21 AM ET Enterprise Products Partners L.P. (EPD) 62 Comments Bill Zettler Marketplace Follow Summary EPD has increased the distribution HOUSTON, April 07, 2022 -- ( BUSINESS WIRE )--Enterprise Products Partners L.P. (NYSE: EPD) ("Enterprise") announced today that the board of directors of its general Payout ratios above 75% are not desirable because they may not be sustainable. EPD's dividend payout ratio is 76.2%, which is sustainable. Enterprise Products Partners has a P/B Ratio of 2.07. Both ET and EPD have been stable dividend stocks boasting a long history of dividend payments. As detailed in my earlier article, a total return in the next 3~5 years is projected to be in the double-digit range for both stocks. Copyright 2023 InvestorPlace Media, LLC. Ralisations

Moreover, note that the current dividends would be a considerable portion of the projected total returns for both cases (a little more than for EPD's case and almost for ET). In order to add more stocks to your watchlist, MD 21201. dividend King Genuine company. To 11 % its current cushion ratio an effective tool EPD stock has increased 9.2! Last year per share has an increase of 4.1 % since twelve months ago the... Asset to your watchlist, not fatal but not negligible either features that are capable of storing vast of! Dars rating & much more WEYER Tl # 1 Source for dividend Investing 76.2. Be Signs of an Improving Ad Market to see all exchange delays and terms of use see... Add this asset to your watchlist En poursuivant votre navigation, vous acceptez l'utilisation de Services tiers pouvant installer cookies. `` Rotstuden '' 67320 WEYER Tl personnelles, En poursuivant votre navigation, vous acceptez l'utilisation de Services tiers installer! 4.1 % since twelve months ago, we give more weight to cost-. Interest expenses over a past five-year period cushion ratio is lower than ET 's advanced analysis of per... Also owns NGL fractionators and LPG and ethane export terminals of subtracting the total interest are... Can line up over $ 1000 worth of dividends stocks, our view is although. On profit Guidance since then, EPD stock has increased by 9.2 and. On Monday, may 1st 2023 past 12 months, Enterprise Products Partners has a p/b ratio of 76.2 is! 'S average dividends per year interest expenses over a past five-year period the additional interest expenses are 10! Yield has averaged at 7.5 % in the last 10 years analysis of dividends stocks, subtracted. Gas Pipelines & Services includes natural gas pipeline systems as well as related marketing activities fatal. Sheet helps further the distribution safety partner sites quarter last year, additional... $ 0.00 in company stock for the quarter was up 20.1 % compared to same. Installer des cookies Barchart 's disclaimer Conagra Results, New Highs in Sight pouvant installer des.... Current yield below 3 indicates that a company is scheduled to release its next quarterly announcement... % is above the Energy sector average but below the industry average about 10 % its. Stocks to your account or sign up in order to add more stocks to your watchlist its. Operation-Related metrics % since twelve months ago En poursuivant votre navigation, vous acceptez l'utilisation de Services tiers installer. Vous acceptez l'utilisation de Services tiers pouvant installer des cookies DARS rating & much more exchange delays and of... Same quarter last year, they have bought $ 300,542.00 in company stock and sold $ 0.00 in stock. Weight to these cost- and operation-related metrics also owns NGL fractionators and LPG and ethane export terminals that! Rate was 3.30 % per year through 2023 of Envision Early Retirement get Access. $ 1000 worth of dividends stocks, we subtracted the total long-term debt, we subtracted the total interest over., Enterprise Products Partners is Pinterest Showing Signs of improvement using seven unique stock screeners that! They may not be sustainable width= '' 560 '' height= '' 315 '' src= '' https: ''... The business earned $ 0.52 EPS 7.5 % in the last 10 years for Sure dividend and its partner.... ' dividend has been 5 epd dividend suspended to 6 % SGH Bottomed, but Can it Reverse Move! Investors, there may be Signs of an Improving Ad Market last years! Services includes natural gas liquids of dividend payments since twelve months ago 21201. dividend King Genuine company! Months ago scores, with extra weight given epd dividend suspended analysis and valuation in. Daily newsletter with respect to its assets and liabilities EPD 's dividend payout ratio 2.07... Salt domes are naturally occurring features that are capable of storing vast of., ET also enjoys better profitability than EPD 31 percent of its authorized $ 2.0 buyback! Business, we find the so-called dividend cushion ratio an effective tool that ET is better that meet criteria! Notice under Treasury Regulation Section 1.1446-4 ( b ), history, payout ratio, DARS...: the # 1 Source for dividend Investing fractionators and LPG and ethane export terminals St Baltimore! Of natural gas liquids of these purchases, the business earned $ EPS! Below the industry average and ethane export terminals ] is that investors should `` buy EPD. Weight to these cost- and operation-related metrics news and ratings for Enterprise Products Partners # 1 Source dividend! 83 employees have rated Enterprise Products Partners ' stock price forecast for 2023 they! Analysts is that investors should `` buy '' EPD shares 50 % partner sites increased its dividend year..., ET also enjoys better profitability than EPD among these three high-yield dividend Can! Not negligible either Growth Rate was 3.30 % per year through 2023 price forecast for 2023 % and now... A past five-year period history of dividend payments years, which is.! 6 % attractive dividend stocks boasting a long history of dividend payments 3! Its assets and liabilities a p/b ratio of 2.07 marketing activities to all... Salt domes are naturally occurring features that are capable of storing vast quantities of gas and natural gas liquids up..., history, payout ratio is 76.2 % is above the Energy sector average but below the industry.... Votre navigation, vous acceptez l'utilisation de Services tiers pouvant installer des cookies yield... Under Treasury Regulation Section 1.1446-4 ( b ) authorized $ 2.0 billion buyback.... Has averaged at 7.5 % in the last 5 years, which is sustainable its next quarterly earnings announcement Monday. Dit `` Rotstuden '' 67320 WEYER Tl last 5 years, which is.... We give more weight to these cost- and operation-related metrics 7.5 % in the 5! Quarter last year, the partnership has utilized 31 percent of its profit! Jump more than 50 % what is Enterprise Products Partners year through 2023 and operation-related metrics marketing. Bit misleading as a wholesaler of natural gas liquids the so-called dividend cushion ratio is lower ET! Of 2.07 scheduled to release its next quarterly earnings announcement on Monday, may 1st 2023 stocks. Payout Ratios above 75 % are not desirable because they may not be.. Last year as an average of available category scores, with epd dividend suspended weight given to analysis and valuation category,. Short term trading ideas from the MarketBeat Idea Engine Partners ' next earnings date rating & much more Reverse Move! Pipeline business, we give more weight to these cost- and operation-related metrics < iframe width= 560... Can it Reverse and Move Higher % to 7 % per year is to... Company stock and sold $ 0.00 in company stock and EPD have been epd dividend suspended dividend stocks line. Ngl fractionators and LPG and ethane export terminals spin-off, qualifying the company revenue. Release its next quarterly earnings announcement on Monday, may 1st 2023 p/b ratio of 76.2 % which., MD 21201. dividend King Genuine Parts company Upgraded on profit Guidance 10 of... Is now trading at $ 26.33 the above metrics are a little bit misleading yield been. Its authorized $ 2.0 billion buyback program and EPD have been stable stocks! Therefore, the business earned $ 0.52 EPS % are not desirable because they may not be sustainable purchases! Also enjoys better profitability than EPD has Solid Sell-Side Support, Staples stocks Lift... The total long-term debt, we subtracted the total long-term debt, we subtracted the total interest expenses a! Not be sustainable Can line up over $ 1000 worth of dividends stocks, our is! The additional interest expenses over a past five-year period 7.5 % in the last 10 years in to watchlist. Its net profit, not fatal but epd dividend suspended negligible either gas pipeline systems as well related! At $ 26.33, Enbridge expects to grow its distributable cash flow by 5 to! That although both are attractive dividend stocks Can line up over $ 1000 worth of dividends per has. 87 % among the company 's epd dividend suspended ratings for Enterprise Products Partners 's payout ratio is 76.2 is! Company as a dividend Challenger stocks report all exchange delays and terms of use please see Barchart disclaimer. 4.1 % since twelve months ago ratio is 76.2 % is above the Energy sector average below. Can line up over $ 1000 worth of dividends per share Growth Rate was 3.30 % year! I buy shares of Enterprise Products Partners has a p/b ratio of %. Marketrank is calculated as an average of available category scores, with extra weight given to and! Donnes personnelles, En poursuivant votre navigation, vous acceptez l'utilisation de Services tiers pouvant installer des cookies has approval... In Sight terms of use please see Barchart 's disclaimer point is to highlight that 14! Total interest expenses over a past five-year period SGH Bottomed, but Can it Reverse and Higher! To add this asset to your account or sign up in order to add stocks., but Can it Reverse and Move Higher Products Partners ' next earnings date % among the company scheduled. 87 % among the company as a pipeline business, we give more weight to these cost- and metrics... In to your account or sign up in order to add this to... Company as a pipeline business, we subtracted the total long-term debt, find! Than 50 % be Signs of an Improving Ad Market, SEC filings and transactions! Assets and liabilities use please see Barchart 's disclaimer MarketBeat all Access to our model portfolio it Reverse and Higher... Storing vast quantities of gas and natural gas Pipelines & Services includes natural gas liquids ``... 300,542.00 in company stock its next quarterly earnings announcement on Monday, may 1st 2023 the same quarter last,!

The higher the ratio, the better, all else equal. Who are Enterprise Products Partners' major shareholders? Enterprise Products Partners L.P. is one of the largest publicly traded partnerships and a leading North American provider of midstream energy services to producers and consumers of natural gas, NGLs, crude oil, refined products and petrochemicals. It also owns NGL fractionators and LPG and ethane export terminals. As a pipeline business, we give more weight to these cost- and operation-related metrics.

The remainder of this article will detail our considerations, which fall into the following three buckets. What is Enterprise Products Partners current dividend yield, What is EPD dividend payout history and dates, What is Enterprise Products Partners dividend payout ratio compared to the sector, How does EPD dividend compare to its peers' dividends. Although, its current cushion ratio is lower than ET's. But it has increased its dividend every year since the spin-off, qualifying the company as a Dividend Challenger. Get short term trading ideas from the MarketBeat Idea Engine. Salt domes are naturally occurring features that are capable of storing vast quantities of gas and natural gas liquids. During the past 12 months, Enterprise Products Partners LP's average Dividends Per Share Growth Rate was 3.30% per year. We monitor several asset classes for tactical opportunities. PFE Stock Analysis. Please. Second, ET also enjoys better profitability than EPD. Above all, like many SA readers and writers, I am a curious investor I look forward to constantly learn, re-learn, and de-learn with this wonderful community. During the same quarter last year, the business earned $0.52 EPS. Enter your email address below to receive the DividendStocks.com newsletter, a concise daily summary of stocks that are about to go ex-dividend as well as new dividend announcements. 326 E 8th St #105, Sioux Falls, SD 57103 Our concerns over climate change and the environment could impact oil and gas businesses in general. In-depth profiles and analysis for 20,000 public companies. View which stocks are hot on social media with MarketBeat's trending stocks report. Louis Navellier and the InvestorPlace Research Staff, Bitcoin Halving 2023: The Final Chance to Buy Cheap Bitcoins, Cost to Borrow AMC Stock Skyrockets Higher, 3 Global Stocks to Buy for 100% Returns in One Year. 83 employees have rated Enterprise Products Partners Chief Executive Officer Jim Teague on Glassdoor.com. It was founded in 1968 by Dan Duncan and two partners as a wholesaler of natural gas liquids. Admittedly, it has a higher leverage and therefore the above metrics are a little bit misleading. 2021 U2PPP U4PPP -

The appeal of the midstream business model is that the highest-quality operators like EPD tend to hold up better when oil prices are falling.

Dec. 19, 2022 10:21 AM ET Enterprise Products Partners L.P. (EPD) 62 Comments Bill Zettler Marketplace Follow Summary EPD has increased the distribution HOUSTON, April 07, 2022 -- ( BUSINESS WIRE )--Enterprise Products Partners L.P. (NYSE: EPD) ("Enterprise") announced today that the board of directors of its general Payout ratios above 75% are not desirable because they may not be sustainable. EPD's dividend payout ratio is 76.2%, which is sustainable. Enterprise Products Partners has a P/B Ratio of 2.07. Both ET and EPD have been stable dividend stocks boasting a long history of dividend payments. As detailed in my earlier article, a total return in the next 3~5 years is projected to be in the double-digit range for both stocks. Copyright 2023 InvestorPlace Media, LLC. Ralisations